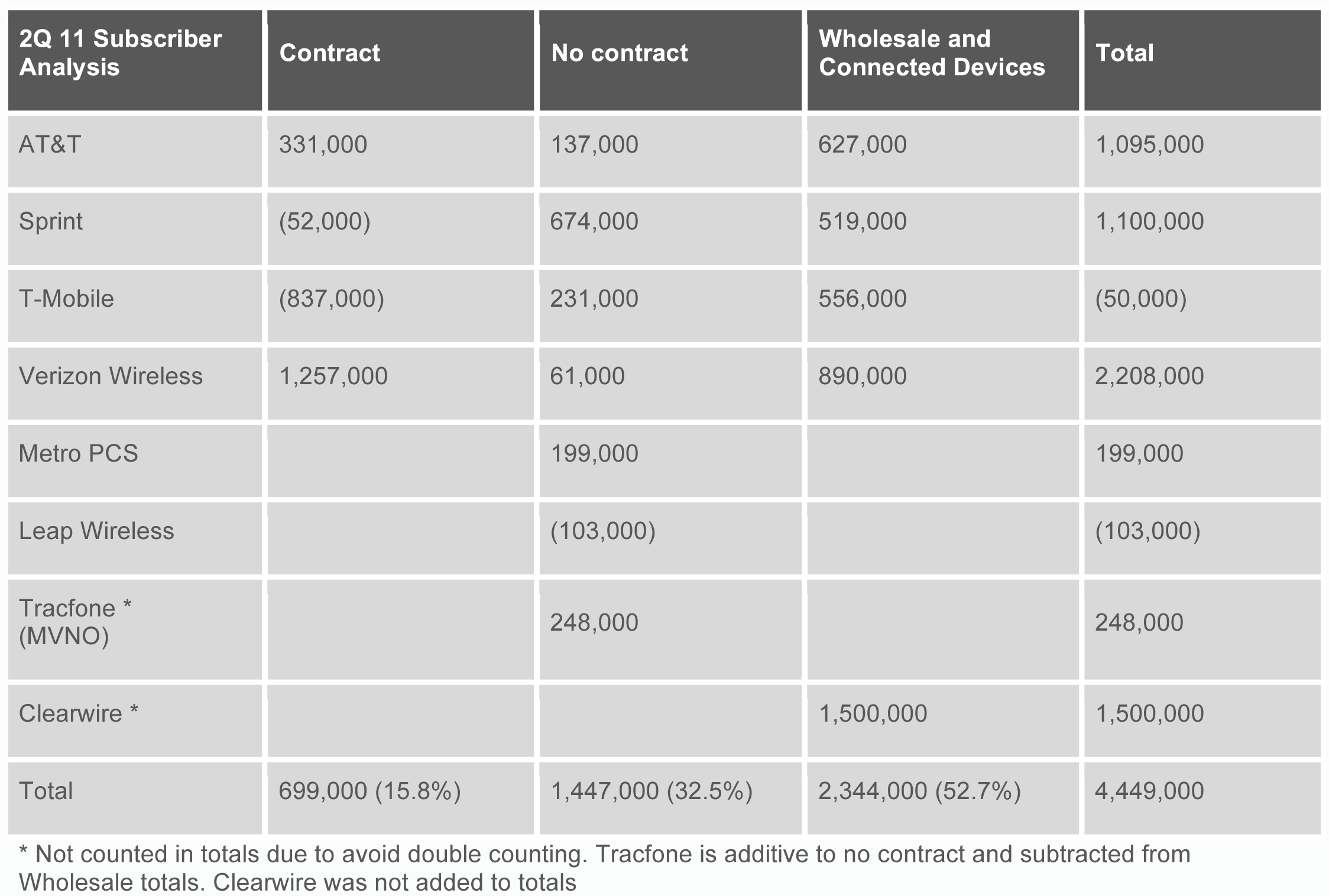

- As every year, the second quarter is a weak net subscriber addition quarter. The overall muted expectations in the economy did not help either.

- Non-operator branded wireless connections are the majority source of customer additions. Almost half of the increase of mobile connections came from customers that mostly do not know the network they were actually using. Amazon Kindles, Barnes & Noble Nooks, countless other connected devices, and MVNOs such as Tracfone were driving the growth of the industry with more than 52% of net additions.

- The second largest growth segment was no-contract with almost a third of new subscriber additions. Contract net additions were less than 16% of overall net subscriber additions.

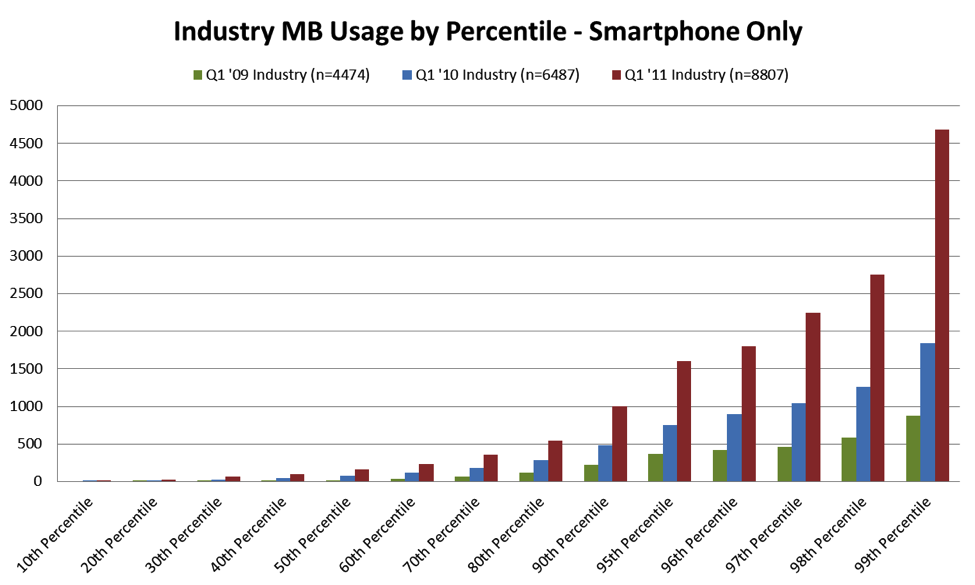

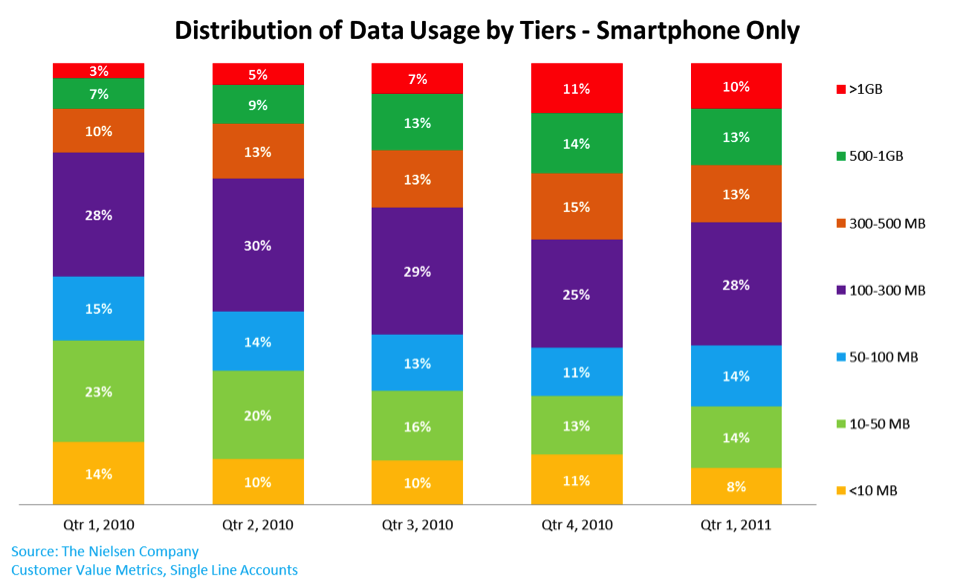

- Smartphones are representing about 75% of device sales and depending on the operator between 29% and 50% of the installed based. Maybe it is time to stop segmenting smartphones from feature phones and report market share and sales figures for phones again?

- Network evolution is the name of the game. Every operator is working on their own flavor of 4G. Sprint dominates the 4G market with 1.7 million 4G net adds compared to 1.2 million Verizon Wireless net adds. Metro PCS nor AT&T had sufficient 4G net adds to mention it during in their earnings.

- Verizon is outperforming everyone else in contract net additions. This is aided by a balanced device strategy that offers something for everyone than. Single and doubles with 4G, iPhone, and feature phones proved to be the contract game winner for Verizon. AT&T’s contract growth is significantly dependent on the iPhone. Sprint’s contract winner are clearly their Sprint-branded 4G devices.

- Sprint’s contract focus area – Sprint-branded – grew nicely by 275,000 whereas the segment that Sprint is no longer intend on growing and therefore not advertising – iDEN – shrunk by 327,000

AT&T kicked off the Q2 wireless earning season. The company gained 1.1 million subscribers of which were 331,000 contract net adds, 137,000 no contract net adds, 379,000 connected device net adds, and 248,000 reseller net adds. AT&T sold 3.6 million iPhones of which 24% were new to AT&T. This means that 900,000 new iPhone contract users joined AT&T. Without this iPhone induced growth, AT&T would have lost about 600,000 contract subscribers. While this trend continued unabated since the Verizon iPhone launch, it may hurt AT&T when the iPhone becomes available at Sprint and T-Mobile that offer lower prices than AT&T and Verizon. Overall AT&T, with the iPhone 4 and 3GS, outsold Verizon with the iPhone 4. Furthermore, iPhone churn fell in this first full quarter of iPhone competition from Verizon. It indicates that the vocal dislike of AT&T was all talk and no substance since no meaningful impact can be discerned in AT&T’s numbers. Data-only internet devices like tablets also grew by 545,000 during the quarter to a total of 4 million customers. Wireless data revenue increased by more than a quarter, leading to an overall increase of total ARPU by 2%, even though voice ARPU declined again.

Verizon reported 2.2 million subscriber net additions for Q2 2011. The net additions were comprised of 1.3 million contract net adds and 890,000 wholesale and other connections. Verizon iPhone sales were 2.3 million with approximately 22% or 530,000 new to Verizon. This was lower than AT&T iPhone sales, but are only iPhone 4, whereas AT&T sells both the iPhone 4 and a $49 iPhone 3GS. The company also mentioned that it had 1.2 million 4G LTE net adds. This comes on the heels of very heavy investments in the build out of Verizon Wireless’ 4G LTE network, which now covers 160 million Americans. Verizon is significantly ahead of its deployment goal and will probably slow down with its 4G LTE build out. Overall ARPU grew on the basis of data revenues growing faster than voice revenues were declining.

Sprint had a good quarter, laying the founding for growth in the next few years. Sprint added 1.1 million subscribers of which 674,000 were no contract, 519,000 were wholesale and affiliate customers, 275,000 Sprint-branded customers, and it lost 327,000 iDEN customers. Sprint also lower contract and no contract churn, which historically was one of the weaknesses of the company. While 1.75% is for Sprint a significant achievement – indicating that the average time a Sprint contract customer stays with Sprint is now more than 4 ½ years – it is only a milestone on the path to close the gap to AT&T and Verizon, who’s contract churn is about 1.1%. What is even more important is that Sprint continued to make progress in terms of customer recognition as preferred provider and customer services. These metrics are leading indicators that indicate toward improvements in Sprint’s net additions and churn.

Sprint’s losses increased by $120 million due to high equipment subsidies, a switch from mail-in rebates to instant rebates, and higher SG&A costs. The $2 increase in contract ARPU that was made possible through the increased expenditure will add $200 million per quarter for at least the next several years. Sprint has also invested more into its network to expand data capacity. Wall Street seems to be intend on punishing Sprint for all investments in the future, apparently blind to the fact that if Sprint does not prepare for the future it will perish. The lesson of T-Mobile’s increasing difficulties caused by chronic underinvestment in its network should be a warning sign for all.

One of the least known facts in the mobile industry is that Sprint’s network is the oldest in the industry. Due to the significant challenges Sprint has it skimped on the network. It easily could as subscriber numbers declined, but now as the company is growing again, it has to put the network house in order. With the already launched Network Vision initiative Sprint benefits greatly from new network elements and the technological advances, and this is just within the CDMA standard, over the last five to seven years. The effect of higher capacity, larger cells, more efficient backhaul will yield immediate savings greater than the cost of the network enhancements. In addition, it will allow Sprint to launch 4G, most likely LTE. Sprint has 10 MHz nationwide in the PCS spectrum band, which is can use to launch the new 4G network. How important 4G overall and Sprint specifically shows its 4G WiMAX net adds. In Q2 2011, it added 1.7 million 4G subscribers. Even Verizon, which is heavily promoting 4G, added only 1.2 million during the same period.

The Sprint LightSquared agreement should be viewed as an LTE expansion and augmentation under the unannounced network vision plan. I would expect some coordination between Sprint and LightSquared about which markets to build out, since from the most recent reports it seems that LightSquared has only core network built by Nokia Siemens Networks. It would allow Sprint to take advantage of LightSquared’s network where needs additional coverage or capacity. The $13.5 billion in cash and network credits are also nothing to cough about.

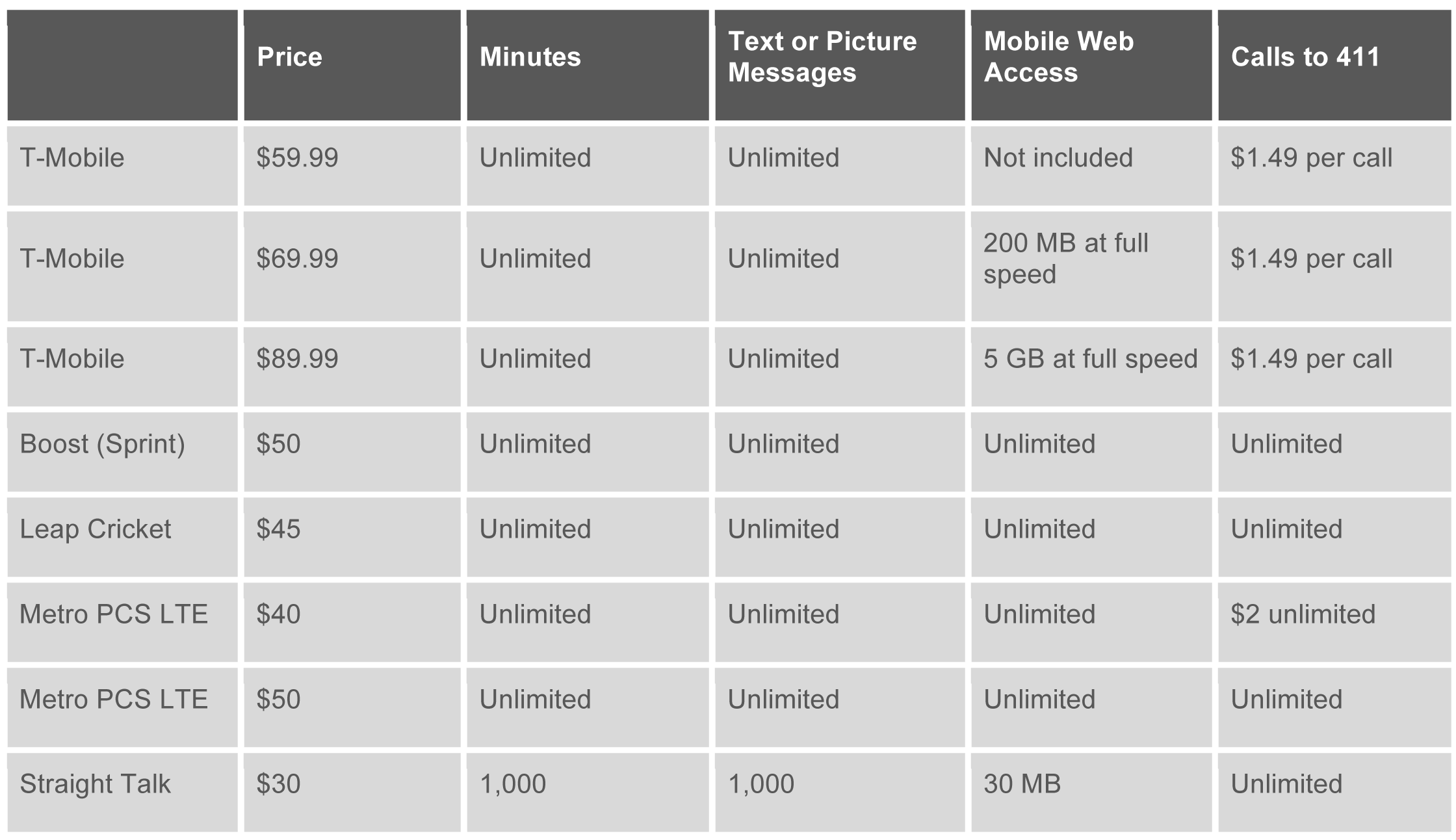

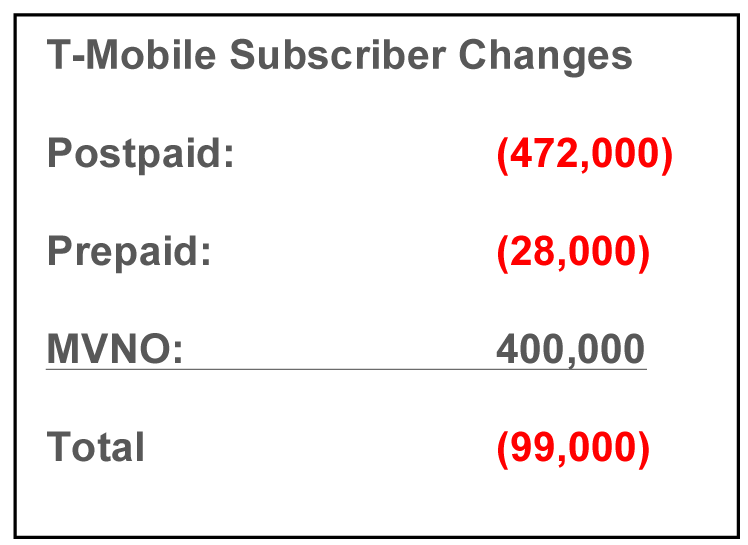

T-Mobile continues to struggle in the market place. At first glance, the company had only a modest customer decline of 50,000. While its connected devices segment grew significantly with 256,000 net adds, the phone contract business continued to hemorrhage customers. In order to improve its contract numbers T-Mobile reclassified its growing MVNO business as contract. By triangulating the data of T-Mobile USA’s and Deutsche Telekom’s earnings releases we can determine that T-Mobile added 300,000 MVNO customers in the second quarter. If we subtract the MVNO net adds and connected device net adds from the contract base, we receive a much clearer picture of T-Mobile’s traditional contract phone-centric business: A net loss of 837,000. The company continues to build out its 4G HSPA+ network and covers now 200 million Americans. Another sign of weakness is that smartphones make up on 29% of T-Mobile’s base, which is now the lowest among the nationwide operators.

MetroPCS added about 200,000 subscribers in the second quarter 2011, slightly below expectations. This was due to the increase in churn from 3.6% a year ago to 3.9% in the most recent quarter. Even MetroPCS, with a customer base that is lower income and exclusively no contract, had a 40% take rate of Android devices among new customers. This is about two thirds of what the large contract operators are reporting. Another interesting data point is that 38% of all subscribers are on family plans, which is in line with the Big 4 national operators.

Leap lost 103,000 subscribers in Q2 2011, as voice customer net adds of 29,000 could not offset 3G broadband customer losses of 132,000. The relative difference in performance between Leap versus Metro and T-Mobile, with one operators offering 3G and the other two offering 4G, is clear. The faster network attracts more customers to data centric devices as both Metro and especially T-Mobile added data-centric customers.

Clearwire announced 1.5 million wholesale net adds. This came on the heels of Sprint announcing it added 1.7 million 4G WiMAX customers in the same time period. The discrepancy indicates that Clearwire’s cable partners have lost 200 WiMAX subscribers and highlights the continued challenges that Clearwire has with its Cable TV partner channel. The Cable companies are continuing to underestimate the challenges wireless solutions provide to integrated service providers. Cable companies are experts in bundling different products into packages that are a win-win for the cable company and customer alike. They instinctively understand that they need a wireless solution in their portfolio, but to everyone’s surprise have not yet figured out how to include wireless into the mix.

Furthermore, Clearwire announced that it will move to LTE TDD subject to more funding. The change to LTE TDD should be relatively cheap considering that Clearwire uses dual-mode base stations that are designed to run LTE and WiMAX simultaneously. One the device side, there should also be few problems thanks to multi-mode chipsets. During the Mobile World Congress in February 2011, Qualcomm announced their MDM9615 chip that is a multimode chipset that lets device manufactures make one device capable of using LTE FDD, LTE TDD, EV-DO Rev B, DC-HPSA+, and TD-SCDMA will make it substantially easier for carriers like Sprint to fully integrate Clearwire’s LTE TDD network into its LTE FDD network.