A raging debate over the future of the U.S. wireless industry has taken center stage in Washington, and attracted the attention of the Europeans whose own wireless industry is imploding. The outcome of the debate will directly impact the US economy, shape US broadband technology and consumer trends for decades and could signal the US government wants to play a much larger role in the marketplace.

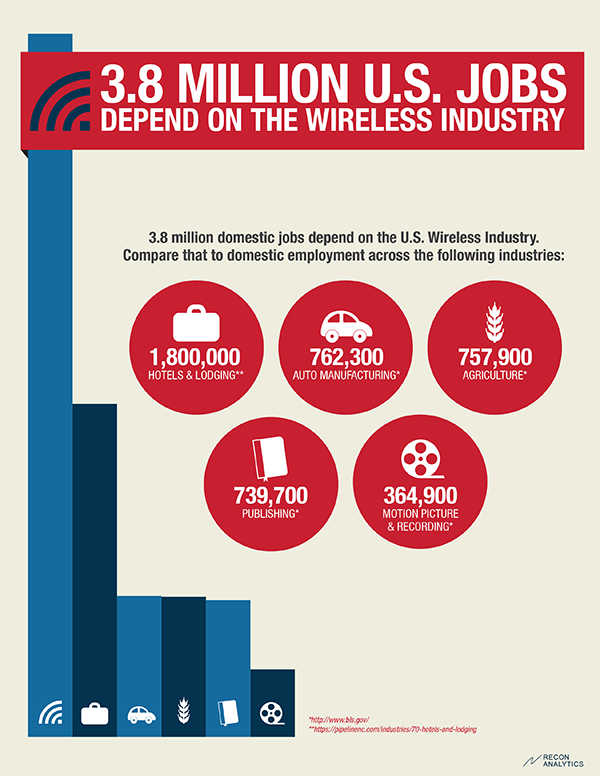

But first, a few words about the debate. At this week’s Senate Commerce hearing, we heard evidence explaining why the most spectrum constrained companies – the companies with more demand on their network than they have capacity to support –need more spectrum and how that would benefit consumers and the US economy. According to CTIA’s Steve Largent, citing Recon Analytics research, the U.S. wireless industry is responsible for 3.8 million jobs, directly and indirectly, accounting for 2.6% of all U.S. employment. The U.S. wireless industry created $195 billion economic activity around the world and would be the 46th largest economy if it would be a country. A total of $146 billion was retained in the United States. The implication being if you feed more spectrum into the pipeline, these growth stats will grow even larger. Representing the interests of smaller carriers, Steve Berry of CCA took a different view of things, and requested government help in improving the competitive positions of his member companies. One of the big asks was for the FCC to ensure that future spectrum is steered away from the most spectrum constrained companies and into the hands of less spectrum constrained companies. In an interesting interjection Senator Warner countered the argument that barring Verizon and AT&T would enhance competition by stating that the only effect of such bidder restriction would be that T-Mobile and Sprint instead would beat the smaller competitors and nothing would have changed – convenient for T-Mobile and Sprint, but nobody else. Meanwhile, the cable companies made the case for making more unlicensed spectrum available and the equipment manufacturer Cisco reconfirmed that our wireless broadband networks are awash in mobile video and are about to collapse under the weight.

The calmly delivered testimony belied the intense policy debate raging through the halls of the FCC and Congress. The FCC and DOJ’s antitrust division have made it clear they would like to manage market share in the industry by restricting spectrum ownership. The two companies the government is eager to help manage are naturally a bit less than enthusiastic about the idea. Competitors of the two companies are of course thrilled with the concept. Three questions seem to be lost in the fury. What is the problem the FCC and DOJ want to solve? Will the proposed solution actually resolve the stated problem? How will consumers be impacted?

The FCC and DOJ are fearful that the two largest companies today may continue to be the largest in the future and prices will go up. Staff at both agencies indicate a concern with an industry where market share is not “more equally” distributed among the multiple providers. The DOJ’s suggested remedy is to limit the amount of spectrum the two largest providers can use to support their networks. As the New York Times put it, the DOJ is suggesting that the FCC limit competition in order to expand competition.

The theory seems to rest on the notion that customers of spectrum constrained companies will experience degraded service quality and higher prices over time, prompting the customers to defect to other providers, presumably the ones with more spectrum and fewer customers. Or perhaps the theory is that steering spectrum away from some of the companies that need it, and into the hands of others that may not need it as urgently, will slow the growth of the larger companies and enable the smaller competitors to essentially catch up. Either way, having a policy that effectively curtails the growth of some companies could certainly shift market share in the industry, but would it produce prices lower than they are trending today? Would it produce more investment in faster build-out of 4G? Would it catalyze the mobile app economy? Would it give the American consumer a better value package than they are currently receiving?

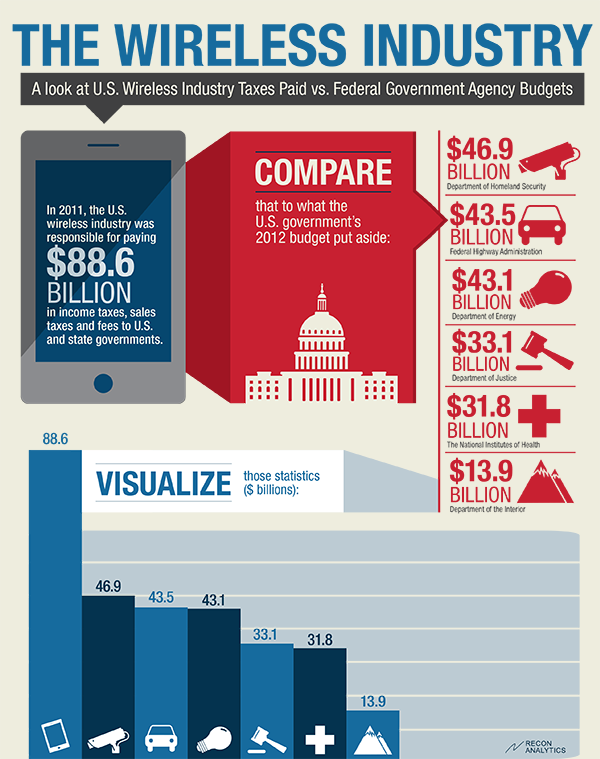

Basic economies of scale and a quick review of recent history tell us that prices are lower when you have an abundance of a resource. Prices are higher when resources are in short supply. Apply that basic concept to spectrum and the US wireless industry and it holds true. Prices for services have declined as more spectrum has come into the marketplace. Just since 2005, prices for voice dropped by roughly 10 percent, prices for data by 90 percent, and for text messages by 85 percent. Billions in investment has poured into the networks in the last 5 years alone – more than $140 billion. In this time of industry consolidation, text book economics predicts a decline in investment, but instead both in absolute numbers and in capital investment per subscribers, we are at or near historic highs. In 2012, wireless carriers invested $1,106 in capital investment per subscribers, a figure that was only higher between 1985 and 1993, when subscriber numbers and wireless networks were in their infancy. And the FCC sped things along by holding spectrum auctions and enabling secondary market transactions, infusing the industry with more spectrum.

Americans have bigger, faster and more capable wireless broadband networks than their European counterparts. Already today, Verizon Wireless is close to covering 90% of Americans with LTE, AT&T has about 65% and both AT&T and T-Mobile expects to have 90% LTE by the end of 2013. Sprint is not far behind and even regional carriers such as US Cellular have launched extensive networks. What are the European carriers doing? Most are launching their first networks in 2014 or 2015 as there are held back by regulatory dictates. It comes as no surprise then that more than half of all LTE subscribers are in the United States. More than a third of American households have found their wireless connection so useful, reliable and affordable that they have completely cut the cord. According to an ITIF report[i] , US wireless broadband networks “speeds are higher than generally thought”, being “ranked 8th tied with Denmark” for average speed but “less well provisioned with spectrum” than those in other countries, reaffirming again the spectrum shortage the U.S. is already experiencing.

Regulators and policymakers are right to keep a close and careful eye on the sector. But managing market share by restricting spectrum ownership seems a risky experiment, and one that should be catching the attention of industries beyond wireless. If the US government finds it appropriate to cap a company’s growth at specific market shares when there are no indications of anticompetitive behavior or rising consumer prices, what is to stop the government from looking at all sectors of the US economy and jumping in with vigor to manipulate specific company’s growth prospects?

American regulators and critics of the US mobile industry have long judged the US harshly as compared to its European counterparts. But the current reality of the European mobile marketplace provides a stark reminder that theoretical niceties of competition policy have precious little to do with getting networks built, increasing capacity and driving prices down. Billions and billions of investment in the networks are what build the networks, drive consumption and reduce prices. Preventing billions of investment from being made would seem the exact wrong policy to pursue in the U.S.

While Washington wrestles with theories of competition and ideal market structure, companies like Softbank and Dish, and the recently refreshed T-Mobile, are actively jockeying for position to take on the largest two providers just as companies are ramping up their build of 4G. The next few years hold tremendous promise for consumers, the industry, and the US economy. Let’s hope Washington doesn’t limit competition in the name of promoting it before this happens.

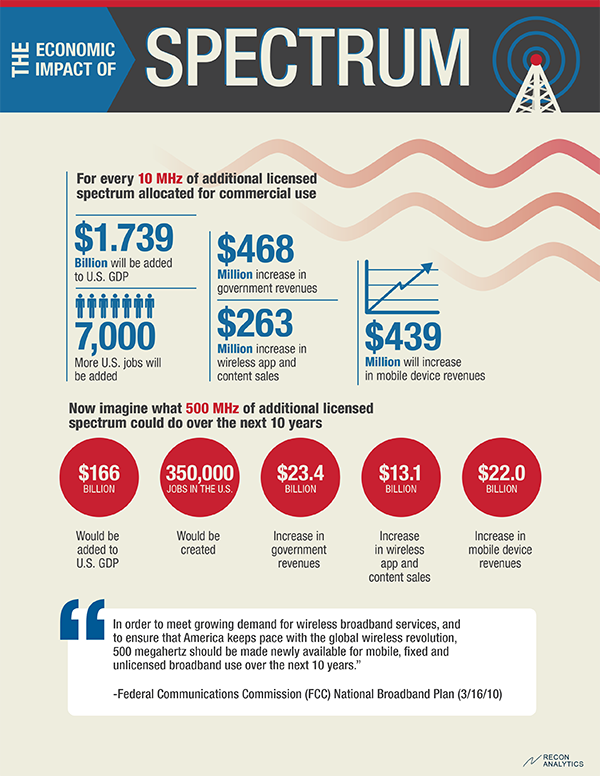

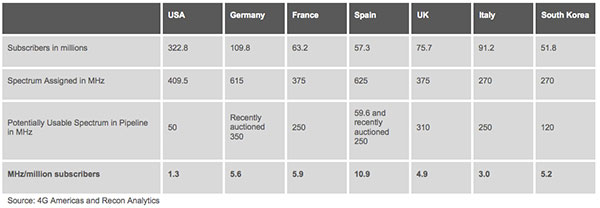

As one can see in the table above, United States mobile operators are facing a significantly more constrained supply of spectrum suitable to support wireless data as compared to their foreign counterparts. When we normalize the spectrum available per person, the United States consumer is by far in the worst position. It has per person, only 1/3 of the spectrum available than Italy where demand for wireless data is comparatively weak. Other countries have assigned three to eight times as much spectrum per person to satisfy the demand for data. Consider the impact on service prices if the FCC really opened up the spectrum spigot. When spectrum was still plentiful in the United States, the wireless operators competed prices to the lowest in the industrialized world. The same competitive forces are at play with regard to wireless data pricing, but could take hold faster and more intensely if more spectrum were put into the marketplace and regulators allowed secondary markets to work more quickly and effectively. Bravo to the FCC for making 30 MHz of WCS spectrum useable for supporting wireless broadband. More and faster decisions like that will go a long way to accelerating the downward price trajectory for LTE based wireless services.

As one can see in the table above, United States mobile operators are facing a significantly more constrained supply of spectrum suitable to support wireless data as compared to their foreign counterparts. When we normalize the spectrum available per person, the United States consumer is by far in the worst position. It has per person, only 1/3 of the spectrum available than Italy where demand for wireless data is comparatively weak. Other countries have assigned three to eight times as much spectrum per person to satisfy the demand for data. Consider the impact on service prices if the FCC really opened up the spectrum spigot. When spectrum was still plentiful in the United States, the wireless operators competed prices to the lowest in the industrialized world. The same competitive forces are at play with regard to wireless data pricing, but could take hold faster and more intensely if more spectrum were put into the marketplace and regulators allowed secondary markets to work more quickly and effectively. Bravo to the FCC for making 30 MHz of WCS spectrum useable for supporting wireless broadband. More and faster decisions like that will go a long way to accelerating the downward price trajectory for LTE based wireless services.