AI Choice 2026: Why Licenses Don’t Equal Adoption

February 3, 2026 | Joe Salesky, Analyst & Head of AI Research

Despite Microsoft’s enterprise distribution advantages and Office 365 integration, Microsoft Copilot lost 7.3 percentage points of paid subscriber share in seven months while Google Gemini gained 2.9 points, based on more than 150,000 respondents. Distribution advantages do not lock in market position. Employees receiving enterprise AI tools evaluate options and select based on experience. The platform that delivers the most reliable results wins, regardless of vendor seat licenses.

The 39% Market Contraction

Copilot’s decline from 18.8% in July 2025 to 11.5% in January 2026 represents a 39% contraction in market position among U.S. paid AI subscribers. This occurred during a period when Microsoft actively invested in enterprise distribution and deepened Office 365 integration. The platform accesses the same OpenAI models as ChatGPT, so underlying capability is comparable. The divergence in user perception points to product experience and integration execution rather than model quality.

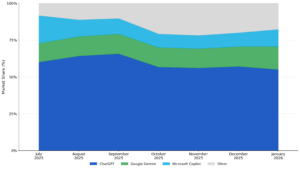

ChatGPT maintained dominant share near 55.2% with modest erosion from 60.7% in July. Gemini climbed from 12.8% to 15.7%, crossing Copilot in late November to claim the number-two position. The two platforms now separated by more than 4 percentage points, with Gemini’s trajectory continuing upward while Copilot stabilized in the 10-12% range.

Exhibit 1: Primary Platform Share Among U.S. Paid AI Subscribers

Source: Recon Analytics U.S. AI Survey, July 2025 – January 2026. U.S. paid subscribers only.

The Workplace Conversion Gap

When Copilot is the only AI platform an employer provides, 68% of workers adopt it as their primary tool. This demonstrates meaningful uptake when alternatives are absent. The competitive dynamics shift when employers offer multiple platforms.

Among workers with both Copilot and ChatGPT available, Copilot’s adoption falls to 18% while ChatGPT captures 76%. When all three major platforms are available, only 8% choose Copilot while 70% choose ChatGPT and 18% choose Gemini. The pattern is consistent: as worker choice expands, Copilot adoption collapses.

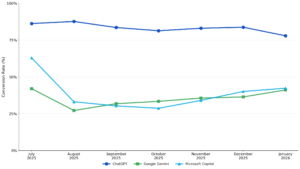

ChatGPT converts 83.1% of U.S. paid subscribers who have workplace access. Copilot converts 35.8%. Gemini converts 34.0%. The 47-point gap between ChatGPT and Copilot quantifies the adoption challenge. Microsoft’s Office 365 distribution creates exposure. That exposure does not automatically translate to preference when workers evaluate alternatives.

Exhibit 2: Workplace Conversion Rates by Platform

Source: Recon Analytics U.S. AI Survey, July 2025 – January 2026. Workers with paid AI subscriptions only.

Quality Perception Drives Share Movement

Gemini’s rise correlates with quality leadership. The platform posts the highest accuracy satisfaction scores among major competitors, 23 points above Copilot and 9 points above ChatGPT. Copilot’s decline correlates with the lowest accuracy perception in the market. Quality drives share movement, not deployment volume.

Copilot’s accuracy NPS remained persistently negative throughout the measurement period. July showed -3.5, September declined to -24.1, and January finished at -19.8. The gap is not closing. Users who tried Copilot and stopped using it cited distrust of answers at 44.2%, exceeding comparable figures for Gemini (42.8%) and ChatGPT (40.6%).

The correlation between accuracy perception and market share movement is direct. Platforms investing in quality gain share. Those relying on ecosystem integration without matching quality lose share.

The Enterprise Market Remains Contestable

Multi-platform enterprise deployment is common. Among U.S. paid subscribers with Copilot available at work, over half also have ChatGPT available. Workers evaluate options and select based on experience rather than defaulting to whatever platform their employer provisions.

The enterprise AI market is not winner-take-all. Every renewal cycle presents an opportunity for challengers to displace incumbents based on demonstrated superiority. Microsoft’s enterprise dominance in productivity software does not foreordain Copilot’s dominance in AI. Google’s Workspace position does not guarantee Gemini’s success. The platforms that execute on accuracy, integration, and use case demonstration will capture enterprise spend in 2026.

ChatGPT’s 83.1% workplace conversion rate and 55.2% market share reflect entrenched product-market fit. Competitors are not displacing ChatGPT. They are competing for second position. Gemini demonstrated that share can shift when product experience improves. Copilot demonstrated that share can decline when it does not.

Report Details

User Illusion: Licenses Don’t Equal Adoption

U.S. Paid AI Subscriber Market Analysis | July 2025 – January 2026

The complete 24-page report includes detailed analysis of:

- Platform-by-platform strategic implications for Microsoft, Google, and OpenAI

- Use case performance across web search, research, writing, coding, and data analysis

- NPS trajectories showing accuracy perception trends over seven months

- Churn intent and retention dynamics by platform

- Investment theses for enterprise AI market positioning

📊 View Report Details & Purchase →

For licensing inquiries: [email protected]